services

Dependable financial management expertise

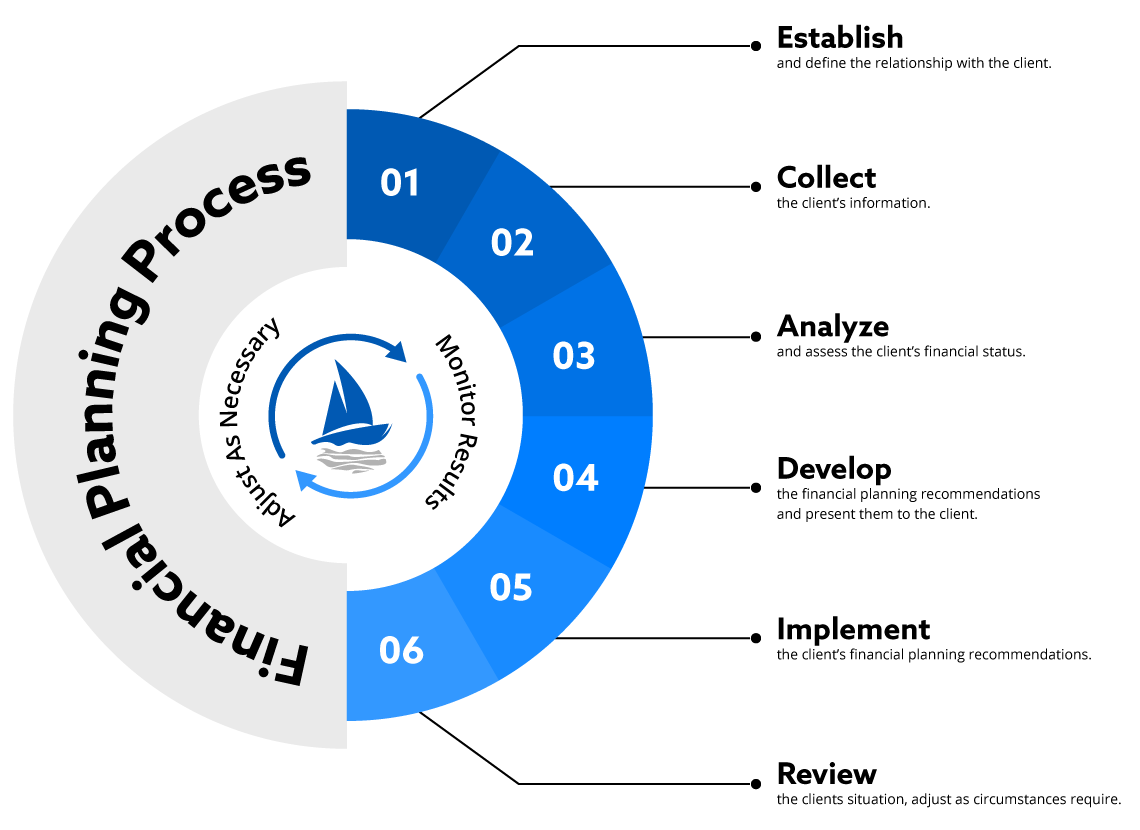

Financial planning is an evaluation process that helps individuals and businesses make positive and productive financial decisions based on current known variables. A financial planner gathers relevant data to analyze financial situations and then propose practical solutions. Financial barriers arise inevitably in almost every stage of life. Therefore, it is vital to have a sound financial plan in place. Monitoring and updating a financial plan on an ongoing basis is also important. A personal financial plan covers areas such as estate, risk management, retirement, and insurance. Without professional consultation and planning, it’s literally impossible to make wise financial decisions and achieve your future goals.

From beginning to end, our financial planners will guide you throughout the process keeping in view your goals, current economic situation, and economic background. Implementing and monitoring your financial plans will streamline your life and help you make necessary adjustments that will align your goals with your current economic situation.

If you are ready to materialize your financial dreams, Kewcorp Financial is more than happy to assist. We provide comprehensive financial management services: proactive tax planning, estate planning, insurance management, retirement planning, and investment guidance.

Investments and Retirement

Investments and Retirement

Kewcorp Financial values your retirement assets. We recommend investment allocations that protect as well as grow your capital into retirement.

READ MORE

Insurance

Insurance

Kewcorp Financial provides a broad view of the insurance industry. We are affiliated with many companies which enables us to provide products best suited to your circumstances.

READ MORE